New budget: From where money will come and go

Senior Reporter || risingbd.com

Finance Adviser Dr Salehuddin Ahmed on Monday presented a Taka 7,90,000 crore national budget for FY26.

The revenue target of the budget is Tk 5.64 lakh crore. Of the total estimated revenue income of Taka 5,64,000 crore, Taka 4,99,000 crore is expected to be collected through the NBR, while the remaining Taka 65,000 crore from other sources.

Annual Development Programme (ADP): Taka 2.30 lakh crore. Of the total ADP outlay for the FY26, Taka 1,44,000 crore will come from the government of Bangladesh portion while the rest of Taka 86,000 crore as project loan and grant.

Budget deficit-- Taka 2.26 lakh crore: Of the total deficit in the proposed budget, Taka 1,25,000 crore are proposed to be financed from domestic sources and Taka 1,01,000 crore from foreign sources.

The government proposed an allocation of Tk 1,16,731 crore for the social safety net sector in the upcoming fiscal year 2025–26. Of the total amount, Tk 91,297 crore is earmarked specifically for social protection programs excluding pensions.

Finance Adviser Salehuddin Ahmed proposed an allocation of Tk95,644 crore for the education sector in the national budget of Bangladesh for the fiscal year 2025-2026, up from Tk7,482 crore from the current fiscal.

The proposed budget, 12.7% of GDP, has a high focus on curbing inflation further, generating more employments, facilitating trade and commerce, attracting more investments and giving respite to poorer section of people through raising safety net coverage and allocations.

The projected budget deficit would stand at Taka 226,000 crore, down from Taka 256,000 crore in the current fiscal year, representing 3.6% of the GDP.

To meet the budget deficit, the government will rely on foreign borrowings, bank loans, and savings certificates.

The revenue collection target for FY26 has been set at Taka 5,64,000 crore in the next fiscal year 2025-26, which will be 9.0 percent of the GDP. “Of this, I propose to collect Taka 4,99,000 crore through the NBR sources and Taka 65,000 crore from other sources,” the adviser said

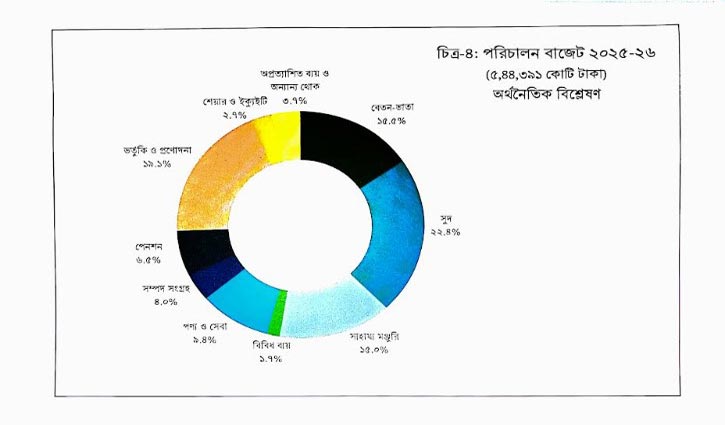

Non-development expenditures will rise, with major allocations earmarked for debt servicing, food subsidies, and banking sector reforms.

The non-development expenditure would reach Taka 560,000 crore, an increase of Taka 28,000 crore compared to the current fiscal year’s allocation. Besides, subsidies for agriculture, fertilizers, and electricity will continue to support key industries.

The budget witnessed steps to reduce the cost of doing business and align tax policies with the requirements of LDC graduation.

Hasan/Mukul