Walton’s IPO subscription begins on Sunday

News Desk || risingbd.com

Economic Reporter: Public subscription of Walton Hi-Tech industries Limited begins today (August 9) with the company’s aim of raising a capital worth Tk 1 billion from capital market under the book building method.

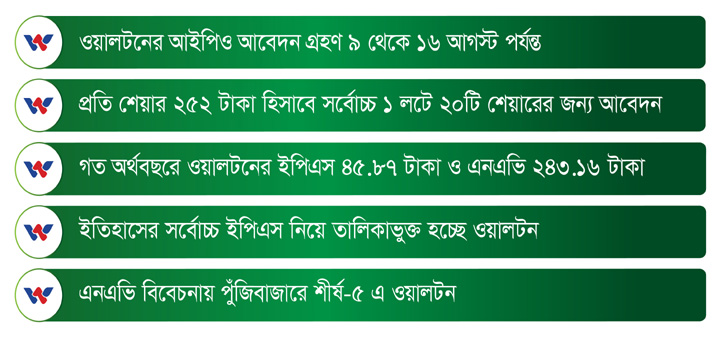

The IPO subscription will be continued until August 16, issue manager sources confirmed.

A beneficiary account (BO) holder can apply only for a single lot and each lot is consisting of 20 shares. Price of Walton’s each share for both resident and non-resident Bangladeshis set at Tk 252 and thus a BO account holder can apply for a single lot at Tk 5,040.

According to capital market sources, the opening of Walton IPO made the capital market’s general investors enthusiast. Walton’s last year Earnings per Share (EPS) as well as Net Assets Value (NAV) per share were allured the IPO (Initial Public Offering) investors.

Considering Walton’s EPS, NAV and overall business performance, the general investors hoped that they will earn desired capital gains through investing in Walton share. And so, they have been awaiting for opening the public subscription of Walton.

As per the company’s financial statement as of June 30 of 2019, WHIL’s NAV with revaluation reserve per share was recorded at Tk 243.16 while its EPS was Tk 45.87.

It was known that Walton Hi-Tech is going to be listed in capital market with ever highest EPS recorded during the IPO.

Analyzing the last year’s financial statements of the listed companies in the capital market, it was found that Walton is in the eighth position in terms of EPS Tk 45.87 while securing the fifth position in terms of NAV per share.

Walton’s EPS’s was even higher than the EPS of the listed multinational companies.

Kazi Ahsan Habib, chief business operation of Prime Bank Securities, said that Walton EPS, NAV and overall business performance posted in its prospectus were very satisfactory and also fulfill the criteria of a good issue.

Professor Dr. Md. Mizanur Rahman, chairman of Marketing Department of Dhaka University, said that Walton’s listing would have a positive impact on capital market. This initiative will not only bring back the general investors’ confidence on the market but also assist to accelerate the progress of national economy, he added.

Md. Ataur Rahman, a general investor from Joytun Securities International, said that no IPO have been issued in capital market for the last seven months.

Most of the listed companies through IPO in last year could not meet investor’s desired expectations failed to meet expectations level, saying it he added, “As a result, we (general investor) lost our confidence in capital market investment.”

In this situation, he said that the listing of Walton Hi-Tech like strong asset based company make a good hope for the general investors.

Now, most of the investors are awaiting for investing in Walton share through IPO, saying it he expressed the hope of earning good capital gains from that investment.

Bangladesh Securities and Exchange Commission (BSEC) on June 23 approved the IPO proposal of the Walton Hi-Tech to raise a fund worth Tk 1 billion in capital form by issuing nearly 2.93 million ordinary shares.

As per the stock market regulator approval, the eligible investors will get 1.38 million shares of the company at the cut-off price of Tk 315 each, fixed earlier through electronic bidding.

And, the general investors will get the remaining 1.55 million shares through IPO at Tk 252 each, a 20 per cent discount on cut-off price, as the company gave 10 per cent additional discount considering the interest of the capital market and small investors.

The IPO proceeds will be utilised for expansion of its businesses, repay bank loans and meeting the IPO related expenses. AAA Finance is in charge of issue manager of the company.

Dhaka/Akram Hossain Polash/Nasim