Prospect of expanding Afghanistan-Bangladesh trade

Humaira Binte Kabir || risingbd.com

The interest of the small business groups in Bangladesh to increase engagement with Afghanistan has increased recently.

Though Afghanistan has not been in the radar of leading businessmen and exporters, small business leaders see the prospect of 100 million US dollars with the South Asian country in the next couple of years.

According to available sources, the trade between Bangladesh-Afghanistan is hovering at some 30 million US dollars.

Bangladesh’s export to Afghanistan recorded at $8.8 million (8858124.13 US dollars during the July-March period of 2024-25, according to data of the Export Promotion Bureau (EPB) Bangladesh ’s export to Afghanistan recorded at (10 million US dollars) 10164582.64 US dollars during the July-June period of 2023-24 fiscal year, according to data of the Export Promotion Bureau (EPB).

Some 42 per cent of Afghanistan’s total exports go to Pakistan, 40 per cent to India, 4.00 per cent to China, 2.00 per cent to UAE and 2.00 per cent to Turkey, according to Afghanistan data of Afghanistan.

Afghanistan, the landlocked country in South Asia, can offer the best quality of fruits to Bangladesh at the most competitive prices compared to countries like South Africa, Brazil, China, Australia, India, Pakistan and Egypt, sources said.

Apples come from South Africa, Brazil, China, and Australia, pomegranates from India, pears from Pakistan, sweet oranges from Egypt, tangerines from China and India, and grapes from India, industry people say.

Bangladesh roughly spent $450 million in 2021-22 fiscal year to procure fruits from the countries like India, Pakistan, Egypt, South Africa, Brazil, China and Australia, industry people say.

Traders opened LCs worth $247.26 million in July-January of 2023-24 fiscal year, up 25.81 percent year-on-year, central bank data showed.

The purchase from external sources was $196.54 million in the identical seven months of the previous financial year and $326.33 million in 2021-22.

About 40 percent of the country's demand for fruits is met locally, while the rest comes from imports.

Afghanistan exports dry food to Bangladesh through Karachi and Chittagong ports as the South Asian county is a land locked one.

Afghanistan has the population of over 40 million and Bangladesh can penetrate in the Afghan clothing market, said a member of the Bangladesh Garments Manufacturers and Exporters Association (BGMEA)).

Sources said China has the largest penetration of clothing market in Afghanistan.

Meanwhile, Afghanistan’s economy is projected to grow by 2.6 percent in 2025, according to the International Monetary Fund’s latest World Economic Outlook released this week. This forecast places Afghanistan near the bottom of regional growth expectations, reflecting both internal economic constraints and the broader global slowdown.

The IMF’s global growth projection for 2025 stands at 2.8 percent, the lowest since 2020 and the second-weakest figure since the 2009 financial crisis. The report attributes this deceleration to heightened trade tensions, rising tariffs, and policy uncertainty, particularly involving major economies such as the United States and China.

Within Central Asia, Afghanistan’s projected growth rate lags behind several neighboring countries. For instance, Kyrgyzstan and Tajikistan are expected to grow by 6.8 percent and 6.7 percent, respectively, while Uzbekistan is forecasted at 5.9 percent. Even Turkmenistan, with a projected growth of 2.3 percent, is only slightly behind Afghanistan.

The IMF anticipates a modest improvement in Afghanistan’s economic performance in 2026, projecting a growth rate of 3.4 percent. However, this remains below the regional average and underscores the challenges facing the country’s economy.

Afghanistan’s economic outlook is constrained by several factors, including limited access to international financial systems, reduced foreign aid, and restrictions on women’s participation in the workforce. These issues are compounded by internal challenges such as high unemployment, food insecurity, and a fragile banking sector.

The IMF’s report emphasizes the need for structural reforms to enhance economic resilience. Recommendations include improving domestic revenue mobilization, fostering private sector development, and ensuring inclusive policies that enable broader participation in the economy.

According to Al Jazeera in 2021, the U.S. freeze nearly $9.5 billion in assets belonging to the Afghan central bank and stopped shipments of cash to the nation as it tries to keep a Taliban-led government from accessing the money, an administration official confirmed recently.

The official said that any central bank assets that the Afghan government has in the U.S. will not be available to the Taliban, which remains on the Treasury Department’s sanctions designation list.

Taliban officials denounced claims that the United States could regain custody of Afghanistan's frozen central bank funds, warning that any such action would be "unacceptable."

The Taliban-led Ministry of Economy issued the warning in response to the latest quarterly report released to the U.S. Congress on Friday stating that the government in Kabul is not recognized by Washington and has been subjected to economic sanctions.

In August 2021, when Taliban insurgents retook control of the country just days before the withdrawal of all American and NATO troops, then-President Joe Biden froze about $7 billion in assets that were held in the U.S. by the Afghan central bank. Additionally, European countries froze around $2 billion.

Washington subsequently transferred half of the frozen funds, amounting to $3.5 billion, to a newly established "Afghan Fund" in Switzerland. That fund is intended to support humanitarian assistance in impoverished Afghanistan while ensuring that the Taliban cannot access the money, but no payments have since been released.

The remaining $3.5 billion was retained in the U.S. to fund potential compensation for ongoing court cases against the Taliban, brought by families of the September 11, 2001, attack victims.

In August 2021, the United States withdrew the last of its troops from Afghanistan, ending its military presence there after nearly 20 years.

Inflation in Afghanistan turned negative because of currency appreciation and subdued demand. In FY2024, annual inflation dropped from 10.6% to –7.7%, with food prices declining by 11.8% and prices for other items falling by 3.0% (Figure 2.14.2). Deflation resulted as the Afghani strengthened, reducing import prices; demand was subdued; and supply chains suffered fewer disruptions. The appreciation of the Afghani against key currencies, including the Pakistan rupee, Iranian riyal, and US dollar, contributed to lower domestic prices, as imports play a dominant role in the economy (Figure 2.14.3). Monetary policy continued to have little effect on prices. The merchandise trade deficit widened to 36.6% of GDP, reflecting currency appreciation and lower demand for minerals (Figure 2.14.4). In FY2024, exports dropped by 3.5% to $1.8 billion, mainly from reduced demand for Afghan coal in Pakistan and stagnant agricultural exports affected by currency appreciation.

Merchandise imports increased by 13.5% to $8.0 billion. This reflected a 112.5% rise in intermediate goods and a 36.8% rise in consumer goods, fueled by private consumption, with Pakistan and Iran remaining Afghanistan’s largest import suppliers. The overall trade deficit in goods and services remained substantial at 42.4% of GDP, with imports rising by 12.1% and exports remaining stable

Meanwhile, Afghanistan has one of the world’s lowest electricity consumption rates per capita. The country can generate only 20% of its electricity domestically, and barely one-third of its 36 million citizens are connected to the power grid. The remainder of its electricity is imported from Uzbekistan (40.5%), Tajikistan (24.0%), Turkmenistan (20.5%), and Iran (15.0%). The Afghanistan Power Sector Master Plan 2011 forecast electricity demand to rise from 2,800 gigawatt-hours in 2012 to 15,909 in 2032, with an annual growth rate of 9.8%. Peak demand was expected to grow by 8.6% annually, from 600 megawatts (MW) in 2012 to 3,502 MW in 2032. Actual demand in FY2024 was 1,500 MW, largely on track with the forecast.

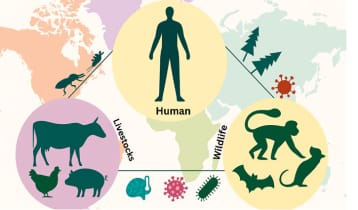

South Asia is one of the least integrated regions in the world in terms of trade and people-to-people contact. At present, regional trade in South Asia accounts for only 5% of estimated $23 billion in trade flow; well below the potential trade of $67 billion. While the ratio of trade in other regions are East Asia: 50%, ASEAN: 26%, EU: 67%, NAFTA: 62%, LAC and COMESA 22%. Referring to the World Bank estimates, ICC Bangladesh reports Intra-regional trade now stands at just one-fifth of trade potential among South Asian countries.

Meanwhile, India and Afghanistan held the highest-level talks since the Afghan group’s takeover of Kabul in 2021 in Dubai in January, 2025. The Taliban's foreign office said they saw India as a "significant regional and economic partner" after meeting with its most senior foreign ministry official, the highest level talks with Delhi since their takeover of Afghanistan in 2021.

Against this backdrop, Bangladesh should explore and increase economic engagement with Afghanistan as the economy of the South Asian county is expanding slowly.

In South Asia, Afghanistan's national currency, the afghani, is one of the strongest currencies against the US dollar. Currently, one U.S. dollar is traded at 72.30 afghani, compared to 69 afghanio.

Dhaka/Mukul